Shopping for a house is not only a monetary choice; it’s a serious life milestone.

From navigating authorized paperwork to coordinating with brokers, lenders, and sellers, actual property transactions include excessive stakes and even larger complexity. It’s not nearly exchanging cash; it’s about ensuring each field is checked and each occasion is protected.

That’s why most offers depend on an added layer of safety: escrow. It’s a course of designed to carry funds, confirm phrases, and preserve the whole lot honest and accountable till closing day.

What’s escrow?

Escrow is a monetary association the place a impartial third occasion holds cash or property on behalf of two events till particular circumstances are met. It ensures each events fulfill their obligations earlier than the funds are launched.

This setup creates a security internet towards fraud, double funds, or untimely fund transfers. In fashionable actual property workflows, it’s usually constructed into digital mortgage closing software program, which helps handle duties like disbursement, tax funds, and mortgage finalization.

TL;DR: Every thing you want to learn about escrow

- What escrow means in actual property: A safe association that holds cash or property till consumers, sellers, or lenders meet all agreed-upon phrases

- Its significance in dwelling shopping for: Protects towards fraud, untimely fund transfers, and missed steps throughout transactions like mortgage closings

- Varieties of escrow accounts: Actual property escrow, mortgage escrow accounts, on-line escrow for giant purchases, and M&A escrow for asset transfers

- The way it works: Funds go into an escrow account and are solely launched after inspections, paperwork, and phrases are verified

- Challenges with escrow accounts: Added service charges, escrow shortages, fund delays, and better month-to-month funds resulting from reserves

Now that we’ve outlined it, let’s have a look at what escrow truly does and why it performs such an important position in actual property, on-line commerce, and enterprise finance.

How does escrow work in actual property?

Actual property transactions are susceptible to dangerous outcomes. Having an escrow firm in place assures the client and the vendor that the method stays protected from forgery. Right here’s how a typical course of works:

- Purchaser deposits earnest cash: As soon as a purchase order supply is accepted, the client deposits earnest cash into an escrow account. An earnest cash deposit reveals the vendor that the client is severe about making the acquisition and has the monetary means to comply with via with it.

- Escrow agent begins coordination: The escrow firm verifies the property title, works with each events to make sure inspections are scheduled, and confirms the client’s financing and appraisal.

- Repairs, walkthroughs, and ultimate prep: Throughout escrow, the vendor sometimes completes agreed-upon repairs, removes the itemizing, and prepares the property for closing. The customer has the chance to do a ultimate walkthrough to verify that the property’s situation meets expectations.

- Authorized checks: An exhaustive title search is carried out to ensure there aren’t any present liens, unpaid taxes, or possession disputes. Any unresolved authorized or monetary obligations can delay or cancel the transaction.

- Closing and fund launch: As soon as all inspections, authorized verifications, and mortgage circumstances are glad, the escrow agent distributes the funds to the vendor, data the brand new possession, and finalizes the sale. At this level, the deal formally “closes,” and the escrow course of ends.

Earlier than organising an escrow, each homebuyer ought to pay attention to these elements:

- House worth: Evaluate the property’s market worth with the quoted worth of the vendor. Generally, sellers elevate the house worth available in the market. In case your lender finds a discrepancy between the quoted value and the market worth of the property, you’ll be denied a mortgage.

- Facility upkeep: Test for repairs, add-ons, replacements, and electrical performance of the home earlier than organising an escrow account.

- House mortgage or mortgage: Seek the advice of along with your lender about which escrow service can be the most effective to speculate your funds in.

- House owner’s insurance coverage and property taxes: Reserve part of your month-to-month earnings for property taxes and house owner’s insurance coverage funds.

- Title search: A title search determines that there aren’t any liabilities on the property you’re about to purchase.

- Buy hazard insurance coverage: It’s your obligation to the state you reside in. Escrow disburses the funds for house owner insurance coverage and different insurance coverage in your behalf so that you simply don’t have any debt sooner or later.

What’s an escrow account?

An escrow account is completely different from the short-term escrow used throughout the dwelling shopping for course of. It’s used to pay property taxes and owners’ insurance coverage in your behalf.

In lots of circumstances, lenders require consumers to arrange a mortgage escrow account as a part of the mortgage settlement. As soon as the house buy is finalized, the lender creates the account and begins accumulating funds as a part of your month-to-month mortgage cost. These funds are then held till tax and insurance coverage payments are due, at which level the lender pays them straight.

As a result of your mortgage cost now consists of these extra prices, it could be barely larger than a mortgage with out escrow. However the trade-off is fewer surprises, fewer deadlines, and much much less threat of lacking a cost.

What’s escrow steadiness and the way is it used?

Say you apply for a mortgage in your new dwelling. Together with principal and curiosity, escrow brokers could ask you to pay owners’ insurance coverage prematurely and preserve a sure amount of money reserves in your escrow account. It doesn’t imply you’re double-paying for insurance coverage or property tax, however merely sustaining an escrow steadiness.

Every time your cost is due, the lender will use your steadiness to disburse the cash. Every month, you’ll obtain an escrow account assertion from the lender.

Do you know? The reserve collected at closing (a lump sum) acts as a security cushion in case your property tax or insurance coverage charges enhance unexpectedly. If a purchaser declines escrow after which fails to pay their taxes on time, the federal government can place a lien on the property.

What are the opposite kinds of escrow accounts?

Escrow accounts function inside strict rules, minimizing the danger of fraud or mismanagement. When a mediator takes cost of funds, the client and vendor’s property are in protected fingers.

Earlier than we discover the varied kinds of escrow accounts apart from actual property escrow, let’s shortly evaluate them, together with who makes use of every kind, how they’re launched, and the dangers concerned.

| Escrow kind | Who makes use of it | What it holds | Set off for launch | Widespread dangers |

| Actual property escrow | House consumers, sellers, actual property brokers | Buy funds, property paperwork | Completion of sale circumstances (e.g., inspections, approvals) | Delays in title clearance, surprising charges, purchaser/vendor disputes |

| Mortgage escrow | Householders, mortgage lenders | Property taxes, owners insurance coverage funds | Lender releases funds as payments develop into due |

Escrow shortages resulting from underestimated prices, lender mismanagement |

| On-line transaction escrow | Patrons and sellers on marketplaces or freelance platforms | Funds for items/companies exchanged on-line | Purchaser receives items/companies and confirms satisfaction | Fraud, disputes over supply or service high quality |

| M&A escrow | Buying and goal firms | Portion of buy value | Survival of reps and warranties, regulatory clearance | Disputes over phrases, failure to fulfill circumstances, authorized challenges |

| Inventory-based escrow | Employers and staff in fairness compensation plans | Worker inventory grants or choices | Vesting schedule, efficiency milestones, time-based triggers | Worker turnover, inventory devaluation, failure to fulfill efficiency targets |

What’s a inventory market escrow account?

Within the inventory market, the shareholders don’t have direct possession of the shareholder fairness. For instance, multinational firms retain their top-line of workforce via extra shares. Nevertheless, the staff can’t monetize these shares. They’re held in an escrow account that liquidates solely after the worker spends a bond period with the corporate.

Corporations additionally set some restrictions on how staff can use these shares. The shares will solely be credited to them in the event that they fulfill the escrow agent’s pre-verification checks.

How is escrow utilized in mergers and acquisitions?

Throughout an organization or an asset merger, escrows report the property concerned, patents and emblems, and different necessary paperwork in a repository. Escrow is a protected choice to guard fastened property, present property, and varied marketable securities of the dissolving firm. Signing up for escrow with a good-faith deposit showcases your willingness to take duty for property.

The customer and vendor in a mergers and acquisitions course of want a large number of presidency approvals, workers changes, and cross-border transactions to merge entities efficiently. Escrow does all of the legwork and reduces the monetary burden on finance and accounting groups.

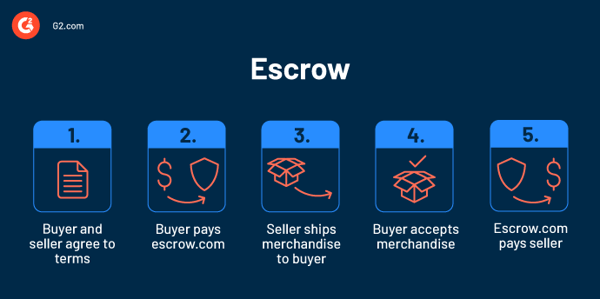

How does escrow work for on-line transactions?

Though escrows can be utilized for any enterprise transaction, it’s wisest to set them up for big-pocket transactions. If you happen to’re shopping for a luxurious watch, a automotive, or a heavy piece of equipment, defend your funds with an escrow.

Escrow conducts a five-step run-through earlier than releasing your deposit to the vendor

- Purchaser-seller settlement: When the client approaches an escrow agent, the agent checks for vendor data, supply date, transport strategies, and high quality inspection of the product or items.

- Purchaser Cost: After the necessary checks, you possibly can open an escrow account and deposit your funds below authorized tips. Your cost is recorded and stored as proof on an earnings assertion.

- Dropshipping: The funds are launched to the vendor solely after the product arrives at its vacation spot in an honest situation.

- Purchaser’s approval: At any stage of escrow service, if the client feels unhappy with the product, the cash is forfeited and refunded.

- Cost launch: After scheduled verification and supervision, the cost is launched.

Do you know? The worldwide software program as a service (SaaS) escrow companies market was valued at $6.7 billion in 2023 and is anticipated to succeed in $26.4 billion by 2033, rising at a CAGR of 14.3%!

Supply: Allied Market Analysis

What occurs when a deal falls out of escrow?

If one thing goes incorrect with the transaction, the property can fall out of escrow. Which means that the deal is unable to work in its present state as a result of one or each events can’t meet a situation within the settlement.

Quite a lot of causes could make a property fall out of escrow, together with:

- An insufficient appraisal

- Structural issues with the property

- Unqualified purchaser

Though this example isn’t best for both occasion, it doesn’t essentially imply the deal is lifeless—it could take longer to shut. The customer and the vendor can renegotiate the phrases and comply with make the required adjustments to maneuver ahead. What this seems like for every occasion varies relying on why the deal fell out of escrow within the first place.

One of the best ways to keep away from falling out of escrow is to stop it from occurring altogether. Prior to creating a proposal, the client ought to have an inexpensive finances in thoughts and be assured they’ll qualify for the mortgage.

However, the vendor ought to be clear about any harm to the property. This manner, the inspection is not going to uncover any new issues that might jeopardize the contract.

What’s an escrow scarcity and the way do you repair it?

An escrow scarcity occurs when there’s not sufficient cash in your escrow account to cowl upcoming property taxes or insurance coverage premiums. This usually outcomes from underestimating prices or surprising will increase in tax assessments or insurance coverage charges.

If the scarcity stays unaddressed, the lender could apply late charges or provoke extra escrow attracts, which might result in additional monetary stress. In excessive circumstances, constant shortages could even threat your tax or insurance coverage funds being missed, exposing you to authorized or coverage-related penalties.

Escrow scarcity vs. escrow deficiency

An escrow scarcity means your account doesn’t have the funds for to cowl future projected prices like taxes or insurance coverage.

An escrow deficiency, then again, means your account has a detrimental steadiness, funds have already been disbursed, and your lender needed to advance the cost in your behalf.

Each can elevate your month-to-month mortgage cost, however a deficiency sometimes requires extra instant reimbursement.

How one can repair an escrow scarcity

Upon figuring out an escrow scarcity, lenders normally supply a number of choices to deal with the deficit, permitting owners to decide on essentially the most appropriate reimbursement methodology. Right here’s how most deal with it:

- Pay the complete quantity upfront: You’ll be able to select to cowl the complete scarcity in a single lump-sum cost. This retains your month-to-month mortgage cost secure, however your general cost should go up in case your property taxes or insurance coverage premiums have elevated completely.

- Unfold the fee over 12 months: If a one-time cost isn’t sensible, you possibly can divide the scarcity throughout your subsequent 12 mortgage funds. It’s a manageable approach to catch up, however your month-to-month invoice will briefly be larger.

- Mix partial and month-to-month funds: Some lenders supply a center floor, pay a portion of the scarcity now, and roll the remaining into future funds. It’s a versatile choice that eases monetary pressure whereas addressing the shortfall.

How are you going to keep away from an escrow scarcity?

To keep away from an escrow scarcity, take into account these proactive steps:

- Observe adjustments to your taxes and insurance coverage

- Add a small buffer to your escrow

- Request a mid-year escrow assessment

- Perceive your lender’s projections

What are the advantages of an escrow account?

Depositing your funds in escrow reduces the chance of future fraud. If a purchaser opens an escrow account, the agent seems into each nook and cranny of that buy transaction earlier than depositing funds to the vendor.

That’s not the one benefit of opening an escrow account.

- For homebuyers, escrow protects the earnest cash till the deal will get finalized. Holding funds with escrow helps the client supervise the property fully earlier than investing. In the event that they detect any fault and not want to proceed, the escrow company refunds the cash.

- For owners, escrow could be an effective way to repay property and insurance coverage taxes on time. It does all of the heavy lifting by way of sustaining tax deadlines and disbursing funds.

- For web consumers, escrows monitor the product’s whole transport journey. When the product is safely within the purchaser’s fingers, escrows launch funds to the vendor.

- For lenders, opening an escrow account helps gather the requisite funds from the loanee and repay recurrent tax payments.

This is a fast side-by-side have a look at the important thing advantages and disadvantages that can assist you make an knowledgeable choice.

| Escrow execs | Escrow cons |

| Protects funds till all contract phrases are met | Requires upfront reserves and better month-to-month contributions |

| Prevents fraud, cost disputes, and untimely fund transfers | Month-to-month funds could rise if taxes or insurance coverage premiums enhance |

| Robotically manages property tax and insurance coverage deadlines | Escrow charges could apply, relying on the supplier and mortgage kind |

| Helps implement authorized obligations and reduces administrative friction | Errors in estimates can result in escrow shortages or overpayments |

| Will increase belief between consumers, sellers, and lenders in high-value offers | Not all the time non-obligatory, usually mandated for sure loans or down funds |

What are the challenges and dangers of escrow?

Not everybody can afford to speculate their cash in escrow as a result of it fees a fee from consumers and sellers. Generally, having an escrow for actual property transactions solely delays the mortgage disbursement and documentation.

Some frequent challenges related to escrows are right here so that you can take into account.

- Opening an escrow account means an absence of belief between purchaser and vendor. This phenomenon can create bitter emotions amongst events and trigger communication gaps.

- Throughout tax foreclosures, escrows won’t be capable of disburse funds to the lender on time. Failure to pay taxes can lead to the potential seizure of property.

- To qualify for an escrow service, the client and vendor should undergo a number of steps of doc verification and mortgage eligibility, which could frustrate each events.

- Escrow checks whether or not a property’s valuation matches its appraised worth. If it does, the vendor can’t elevate the promoting value and will encounter a loss.

Escrow: Often requested questions (FAQs)

Bought extra questions? We’ve the solutions.

What’s an escrow settlement?

An escrow settlement is a authorized contract between the client, vendor, and escrow agent. It defines what funds or property shall be held, below what circumstances they’ll be launched, and every occasion’s duties. It’s important for safeguarding all sides in high-value transactions.

How do I open an escrow account?

To open an escrow account for a house mortgage or property buy, comply with these steps.

- Seek the advice of native consultants: Attain out to your house owner’s affiliation or actual property agent to grasp native escrow necessities and proposals.

- Analysis escrow suppliers: Evaluate licensed escrow firms in your space based mostly on status, charges, and repair phrases.

- Evaluation phrases and costs: Look at the contract fastidiously, together with escrow charges, timelines, and circumstances for fund launch.

- Fund the account: Deposit the required quantity in line with your buy or mortgage settlement.

- Affirm disbursement guidelines: Guarantee all events agree on how and when the funds shall be launched.

- Select a setup methodology: Escrow accounts could be initiated by telephone, electronic mail, web site, or in particular person.

Is escrow necessary for dwelling loans?

Escrow isn’t all the time necessary, however is usually required in case your down cost is lower than 20% or when you’ve got a government-backed mortgage (like FHA). Some typical loans enable debtors to waive escrow in the event that they meet sure standards.

What’s an escrow advance?

Escrow advances are reserves collected by escrow firms prematurely to repay property taxes and insurance coverage once they’re due. The reserve is collected to make sure that your funds don’t run out and also you don’t land in an escrow shortfall.

What’s an escrow scarcity?

A scarcity of funds in your escrow account would possibly lead to an escrow scarcity. Escrow scarcity is mirrored in your month-to-month mortgage assertion, which is a cue for the loanee to submit required checks to the escrow company.

Why does my escrow cost enhance?

Escrow will increase resulting from an increase in tax quantity, insurance coverage curiosity, and mortgage curiosity. Additionally, escrow collects six months or a 12 months’s value of funds prematurely, which results in larger prices.

How do I decrease escrow funds?

Escrow funds could be lowered by negotiating your property’s mortgage tax. If you happen to suppose the tax quantity is just too excessive, you possibly can name your native assessor and reassess it. As your mortgage firm additionally deducts its fee out of your escrow steadiness, you possibly can go for cancellation of your mortgage insurance coverage.

Can I cancel my mortgage escrow account?

You’ll be able to cancel your mortgage escrow account in circumstances the place:

- You have constructed sufficient dwelling fairness (sometimes 20% or extra)

- Your lender permits escrow waivers

- You’ve maintained a strong cost historical past

Needless to say with out escrow, you’ll be answerable for paying taxes and insurance coverage straight.

Do you get escrow a refund at closing?

Sure. If there is a surplus in your escrow account after closing or refinancing, your lender could refund the surplus inside 20 days. The refund is determined by your mortgage phrases and account steadiness on the time of settlement.

The ultimate phrase on escrow

Escrow provides construction, transparency, and safety to actual property transactions. By guaranteeing that funds and paperwork are solely exchanged when each situation is glad, it protects all events and helps offers shut easily.

If you happen to’re planning a property transaction or funding, understanding how escrow works is not simply useful, it is important for lowering threat and gaining peace of thoughts.

Seeking to take management of your property funds? Discover actual property funding administration instruments to trace property, handle offers, and optimize returns with confidence.

This text was initially printed in 2023. It has been up to date with new data.