Rankings for Industrial Metals CMC have been offered by 6 analysts previously three months, showcasing a mixture of bullish and bearish views.

The next desk encapsulates their current rankings, providing a glimpse into the evolving sentiments over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Rankings | 1 | 0 | 5 | 0 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 0 | 1 | 0 | 0 |

| 2M In the past | 0 | 0 | 1 | 0 | 0 |

| 3M In the past | 1 | 0 | 2 | 0 | 0 |

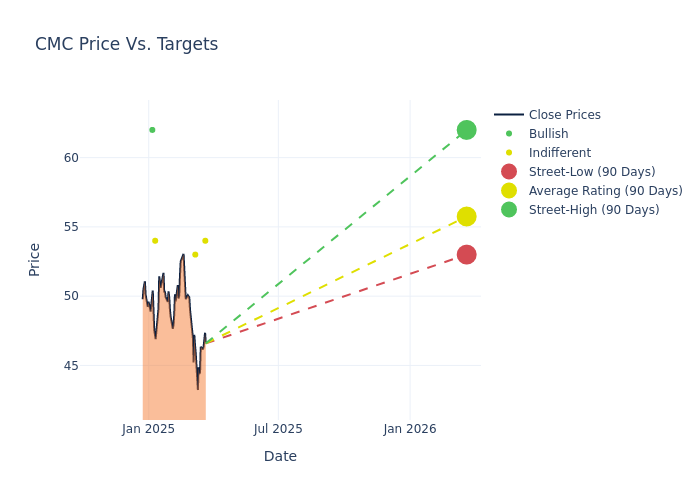

Analysts have just lately evaluated Industrial Metals and offered 12-month worth targets. The common goal is $56.17, accompanied by a excessive estimate of $62.00 and a low estimate of $53.00. This present common has decreased by 6.9% from the earlier common worth goal of $60.33.

Deciphering Analyst Rankings: An In-Depth Evaluation

The standing of Industrial Metals amongst monetary consultants is revealed by an in-depth exploration of current analyst actions. The abstract under outlines key analysts, their current evaluations, and changes to rankings and worth targets.

| Analyst | Analyst Agency | Motion Taken | Ranking | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| Katja Jancic | BMO Capital | Lowers | Market Carry out | $54.00 | $58.00 |

| Piyush Sood | Morgan Stanley | Lowers | Equal-Weight | $53.00 | $56.00 |

| Piyush Sood | Morgan Stanley | Lowers | Equal-Weight | $56.00 | $65.00 |

| Curt Woodworth | UBS | Lowers | Impartial | $54.00 | $56.00 |

| Seth Rosenfeld | Jefferies | Lowers | Purchase | $62.00 | $65.00 |

| Katja Jancic | BMO Capital | Lowers | Market Carry out | $58.00 | $62.00 |

Key Insights:

- Motion Taken: Analysts reply to adjustments in market situations and firm efficiency, continuously updating their suggestions. Whether or not they ‘Preserve’, ‘Increase’ or ‘Decrease’ their stance, it displays their response to current developments associated to Industrial Metals. This info provides a snapshot of how analysts understand the present state of the corporate.

- Ranking: Unveiling insights, analysts ship qualitative insights into inventory efficiency, from ‘Outperform’ to ‘Underperform’. These rankings convey expectations for the relative efficiency of Industrial Metals in comparison with the broader market.

- Worth Targets: Analysts gauge the dynamics of worth targets, offering estimates for the long run worth of Industrial Metals’s inventory. This comparability reveals developments in analysts’ expectations over time.

For invaluable insights into Industrial Metals’s market efficiency, think about these analyst evaluations alongside essential monetary indicators. Keep well-informed and make prudent selections utilizing our Rankings Desk.

Keep updated on Industrial Metals analyst rankings.

Unveiling the Story Behind Industrial Metals

Industrial Metals Co operates metal mills, metal fabrication vegetation, and steel recycling amenities in the US and manufactures rebar and structural metal, that are key product classes for the nonresidential building sector. The Firm has three working and reportable segments: North America Metal Group, Europe Metal Group and Rising Companies Group.

Industrial Metals: Monetary Efficiency Dissected

Market Capitalization Evaluation: The corporate reveals a decrease market capitalization profile, positioning itself under trade averages. This means a smaller scale relative to friends.

Adverse Income Pattern: Analyzing Industrial Metals’s financials over 3 months reveals challenges. As of 30 November, 2024, the corporate skilled a decline of roughly -4.67% in income progress, reflecting a lower in top-line earnings. As in comparison with its friends, the corporate achieved a progress fee larger than the typical amongst friends in Supplies sector.

Web Margin: Industrial Metals’s internet margin lags behind trade averages, suggesting challenges in sustaining sturdy profitability. With a internet margin of -9.2%, the corporate could face hurdles in efficient price administration.

Return on Fairness (ROE): Industrial Metals’s ROE lags behind trade averages, suggesting challenges in maximizing returns on fairness capital. With an ROE of -4.23%, the corporate could face hurdles in reaching optimum monetary efficiency.

Return on Belongings (ROA): Industrial Metals’s ROA falls under trade averages, indicating challenges in effectively using belongings. With an ROA of -2.59%, the corporate could face hurdles in producing optimum returns from its belongings.

Debt Administration: Industrial Metals’s debt-to-equity ratio is under the trade common. With a ratio of 0.3, the corporate depends much less on debt financing, sustaining a more healthy steadiness between debt and fairness, which might be considered positively by traders.

What Are Analyst Rankings?

Analysts are specialists inside banking and monetary programs that sometimes report for particular shares or inside outlined sectors. These folks analysis firm monetary statements, sit in convention calls and conferences, and communicate with related insiders to find out what are often known as analyst rankings for shares. Usually, analysts will fee every inventory as soon as 1 / 4.

Some analysts additionally provide predictions for useful metrics akin to earnings, income, and progress estimates to supply additional steering as to what to do with sure tickers. It is very important take into account that whereas inventory and sector analysts are specialists, they’re additionally human and might solely forecast their beliefs to merchants.

Which Shares Are Analysts Recommending Now?

Benzinga Edge offers you immediate entry to all main analyst upgrades, downgrades, and worth targets. Type by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Momentum27.89

Progress25.69

High quality64.40

Worth77.56

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.