No one enjoys standing in line on the financial institution with a paper test in hand, simply to entry their hard-earned cash. And but, that’s nonetheless the fact for some folks, even in 2025! The excellent news? There’s a greater method.

Direct deposit is a quick, safe option to obtain your paycheck (or any recurring cost) instantly in your checking account (no paper, no postage, and no pit stops on the ATM required).

It’s additionally one of the crucial extensively used cost strategies within the U.S. In actual fact, almost 96% of American employees are paid utilizing direct deposit, making it one of the crucial trusted and widespread cost strategies round.

What’s direct deposit?

Direct deposit is an digital cost technique during which funds are transferred instantly right into a recipient’s checking account. Employers, authorities companies, and establishments use direct deposit to pay salaries, difficulty tax refunds, and distribute advantages.

On this information, we’ll break down how direct deposit works, how lengthy it takes to get began, the way it stacks up towards paper checks, and why so many individuals (and companies) depend on it. And if you happen to’re already utilizing payroll providers or HR software program, direct deposit is probably going just some clicks away.

TL;DR: The whole lot you might want to learn about direct deposit

- What it’s: Direct deposit transfers cash instantly into your checking account, eliminating paper checks.

- Why it issues: It’s sooner, safer, and extra dependable for each workers and employers.

- Who makes use of it for funds: Employers, authorities companies, insurers, and monetary platforms for payroll and recurring funds.

- How direct deposit works: Funds are processed by way of the ACH community and delivered securely to your account.

- Easy methods to set it up: Fill out an authorization type together with your financial institution particulars and submit it to your employer or payroll supplier.

- How lengthy does it take: Preliminary activation can take one to 2 pay cycles. After that, funds often arrive on payday morning.

- Is direct deposit safe: Each transaction is encrypted and trackable, decreasing the danger of errors or fraud.

How do you arrange direct deposit?

To arrange direct deposit, you might want to collect your financial institution info, full a direct deposit authorization type, and submit it by way of your employer’s or payroll supplier’s safe course of. Right here’s a step-by-step breakdown.

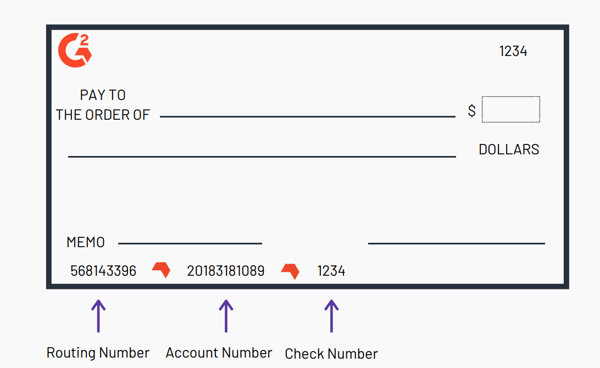

- Acquire your banking information: You’ll want your account quantity, your financial institution’s 9-digit routing quantity, the kind of account (checking or financial savings), and the title and tackle of your financial institution. Some employers additionally ask for a voided test to confirm particulars.

- Fill out the direct deposit type: This way is often offered by your HR crew or payroll software program. It’s easy, however double-check your entries. One improper digit might delay your paycheck. You might also be requested to incorporate your Social Safety quantity and mailing tackle. In some circumstances, employers could provide on-line enrollment as a substitute of paper types.

- Submit the shape securely: Use your employer’s safe portal or hand it in on to HR. Don’t ship banking particulars over unsecured channels like plain e-mail except explicitly directed by your organization.

- Verify with HR: Observe up to verify your type was acquired and ask when the direct deposit will probably be activated.

As soon as arrange, your future paychecks will probably be robotically deposited: no financial institution visits, no envelopes, no drawback.

How does direct deposit work?

Direct deposit works by electronically transferring your cost by way of the Automated Clearing Home (ACH) community, shifting funds out of your employer’s financial institution to your account securely and robotically. We’ve already lined arrange your account. What occurs subsequent is roofed under:

1. Digital switch:

- Earlier than payday, your employer initiates the direct deposit course of. They ship a safe digital notification to their financial institution, which incorporates your banking info and the cost quantity.

- This notification travels by way of the ACH community, a central system that facilitates digital financial institution transfers within the US.

- The ACH routes the data to your financial institution.

2. Receiving the funds:

- Your financial institution receives the notification and verifies your account info.

- As soon as all the things checks out, your financial institution robotically deposits the funds into your designated account on the scheduled day.

- You may sometimes obtain an alert out of your financial institution notifying you of the deposit.

Direct deposit vs. paper checks: A side-by-side comparability

Now that you understand how direct deposit works, right here’s the way it stacks up towards conventional paper checks by way of pace, safety, and comfort:

| Characteristic | Direct deposit | Paper test |

| Velocity | Funds on payday morning | 1–5 days to clear + financial institution holds |

| Safety | Encrypted, traceable ACH | Vulnerable to loss, theft, forgery |

| Comfort | Auto-deposited, no motion wanted | Should manually deposit/test mail |

| Employer value | Minimal, no provides or postage | Expensive over time (paper, ink, envelopes) |

| Recordkeeping | Automated digital data | Handbook monitoring required |

| Environmental influence | Paperless | Paper, ink, and mailing waste |

How lengthy does it take to obtain a direct deposit?

Curious when your first direct deposit will hit your account? Whereas establishing direct deposit is a breeze, it’d take one to 2 pay cycles earlier than you see the cash mirrored in your steadiness.

It is because, in some circumstances, your employer may difficulty a bodily test through the preliminary transition interval to make sure all the things is ready up accurately.

As soon as direct deposit is absolutely energetic, the precise timing of your funds showing is determined by your organization’s payroll schedule and software program. Some companies pay bi-weekly, whereas others go for weekly pay or a hard and fast schedule on the fifteenth and thirtieth.

To keep away from any surprises, it is best to test together with your employer about their payroll administration schedule and when you may count on your first direct deposit.

What are the advantages of utilizing direct deposit?

Direct deposit gives a win-win state of affairs for each employers and workers. It eliminates the trouble of paper checks and supplies a safe, handy option to handle your funds. This is how:

For workers:

- Computerized deposits: Say goodbye to ready for checks to reach or remembering to deposit them. Your paycheck robotically seems in your checking account on payday, prepared for speedy use.

- Peace of thoughts: Direct deposit eliminates the danger of misplaced or stolen checks. Your cash goes straight to your safe checking account.

- Sooner entry: Not like paper checks that may take days to clear, direct deposits are sometimes obtainable instantly on payday, permitting you to entry your funds faster.

- Simplified report retaining: Digital data of your paychecks are available in your financial institution statements, making budgeting and tax preparation simpler.

For employers:

- Price financial savings: Direct deposit eliminates the necessity for printing checks, shopping for envelopes, and postage, decreasing administrative prices related to payroll processing.

- Elevated effectivity: Automated deposits streamline the payroll course of, saving effort and time in comparison with dealing with paper checks.

- Lowered errors: Direct deposit eliminates the potential for errors related to writing and distributing bodily checks.

- Improved safety: There is no danger of misplaced or stolen checks, guaranteeing your workers obtain their pay securely.

Steadily requested questions on direct deposit

Obtained extra questions? We’ve the reply.

1. Is direct deposit protected to make use of for payroll?

Sure, direct deposit is among the many most safe methods to receives a commission. It makes use of encrypted ACH transfers regulated by federal authorities, decreasing the dangers of misplaced, stolen, or altered checks. Plus, each transaction is traceable by way of your employer and your financial institution.

2. What occurs if I swap banks after establishing direct deposit?

If you happen to swap banks after establishing direct deposit, it’s essential to submit a brand new authorization type with up to date account particulars. It’s best to do that at the very least one pay cycle upfront to keep away from delays or receiving a bodily test through the transition.

3. Can I cut up my direct deposit between a number of accounts?

Sure, most employers and payroll platforms will let you cut up your direct deposit between completely different accounts. For instance, you may direct a part of it to checking and half to financial savings. You possibly can often specify precise quantities or percentages throughout setup.

4. How do I do know if my direct deposit went by way of?

To seek out out in case your direct deposit went by way of, test your financial institution’s notifications or your steadiness on-line. If you happen to don’t see it by payday, contact your payroll division to confirm the switch.

5. How lengthy does it take for the primary direct deposit to start out?

For the primary direct deposit to hit your account, it often takes one to 2 pay cycles after setup. Employers typically check the setup by issuing one test earlier than fully switching to digital transfers.

6. Can I take advantage of direct deposit for issues apart from paychecks?

You should use direct deposit for issues apart from your paycheck. Direct deposit is extensively used for presidency funds (like tax refunds and Social Safety), insurance coverage claims, and even funding disbursements. If a payer helps ACH, you may seemingly use it.

It’s all the time greatest to be direct

Whether or not you are receiving or issuing funds, switching to direct deposit can prevent time, cash, and peace of thoughts. Setting up a direct deposit is simple, and very quickly, you’ll see your cost come by way of to your checking account. Don’t spend it multi functional place!

Make direct deposit easy. Discover the greatest payroll software program to automate paydays and simplify your workflow.

FREE Direct Deposit Type

Whether or not you are an employer or an worker who wants a direct deposit type, obtain one right here, dropped at you by G2!

This text was initially revealed in 2019. It has been up to date with new info.